Introduction

In the fast-paced world of banking marketing and sales, speed to market is crucial for targeting high-net-worth prospects and retaining clients over the long term. However, compliance requirements often create roadblocks, causing delays in the marketing and client acquisition process. This blog post explores how CampaignDrive by Pica9, a cutting-edge brand templating platform, can be a game-changer for Retail Bank and Credit Union marketers, enabling them to navigate compliance challenges seamlessly.

The Banking Marketing Conundrum

The Goal: High-Net-Worth Prospects and Long-Term Retention

The primary objective of banking marketing and sales teams is to target high-net-worth prospects and retain them to maximize the overall value derived from each client. This involves creating and disseminating various marketing materials to attract and engage potential clients.

The Problem: Compliance Slows Down the Process

One significant hurdle faced by marketing and sales teams in the banking sector is the stringent compliance review process. Every piece of marketing and communication material needs to be vetted, leading to delays in launching campaigns and acquiring new clients.

CampaignDrive's Solution: Brand Templates for Consistency and Efficiency

CampaignDrive's Solution: Brand Templates for Consistency and Efficiency

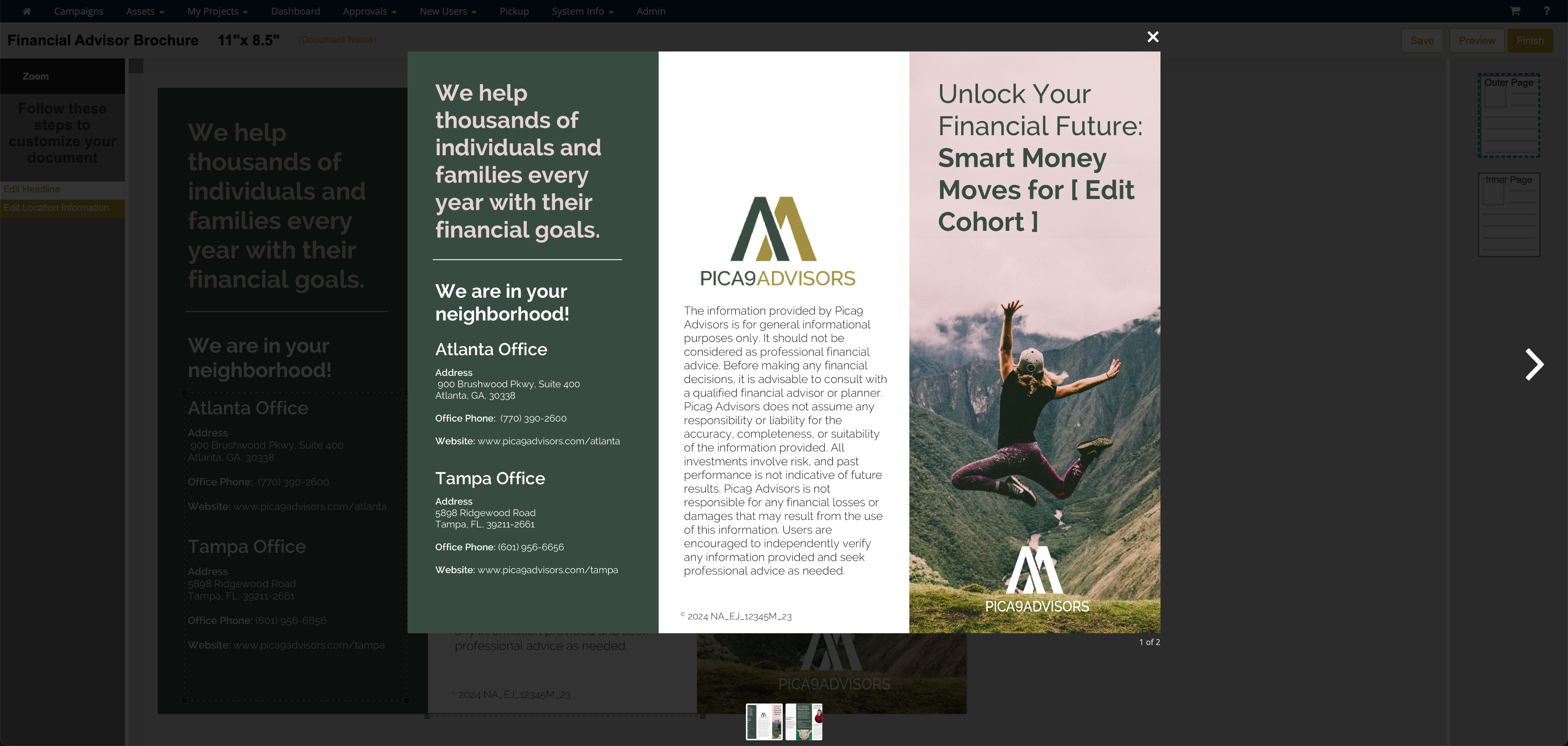

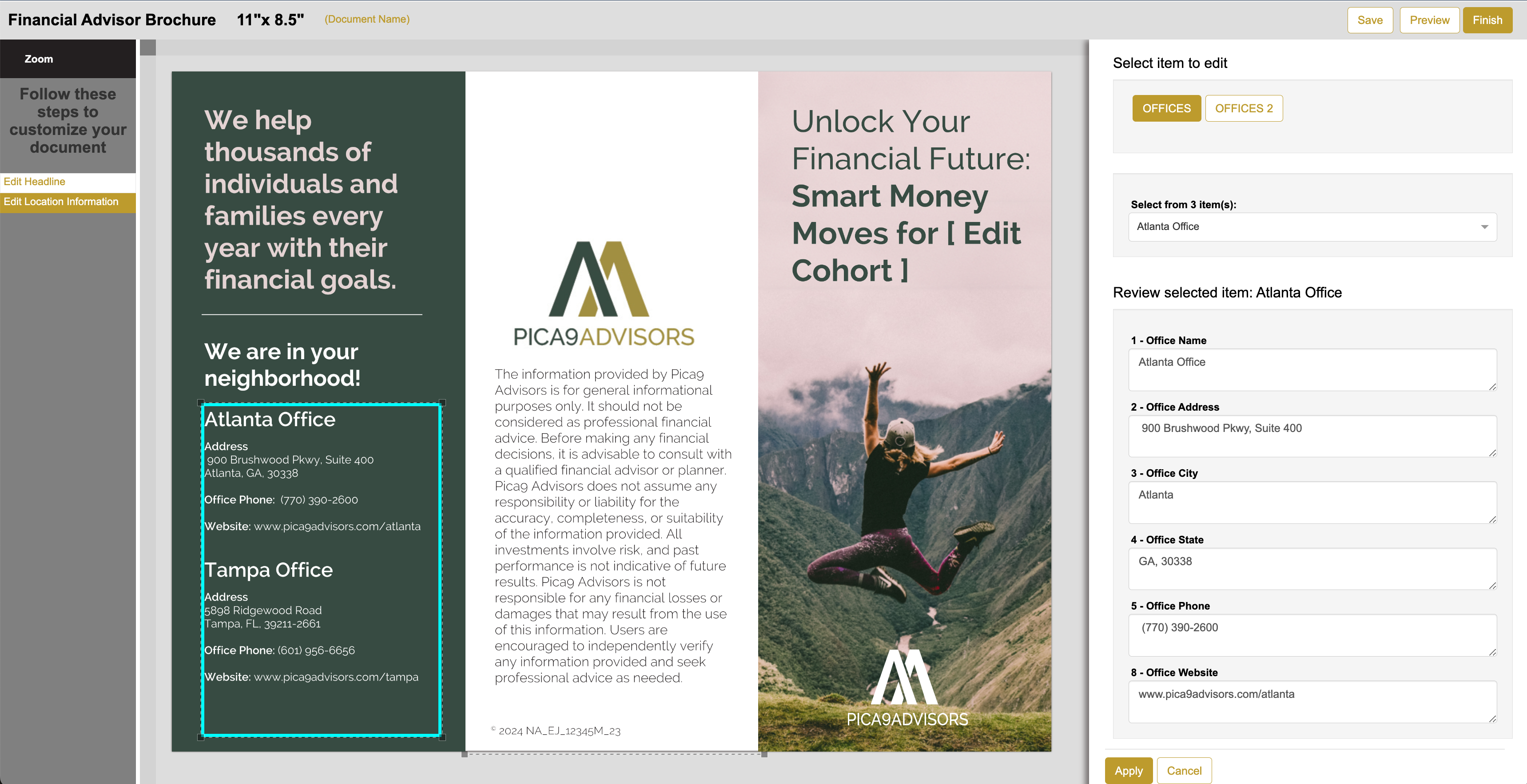

Brand Templates for Material Consistency

Retail Bank Marketing and Sales teams deal with a myriad of material types, including business cards, deal closure announcements, location cards, sell sheets, B2B relationship reviews, and wealth management communications. CampaignDrive's Brand Templates, crafted by the organization's brand/design team, enforce specific brand rules and guidelines. These templates cover typography, colors, spacing, layout, and more, streamlining the creative decision-making process.

Reducing Decision Fatigue

By providing predefined templates, CampaignDrive minimizes the burden on branch managers and financial advisors, enabling them to focus on their core responsibilities. This approach significantly reduces the opportunity for creative inconsistencies to occur across different marketing materials.

Ensuring Compliance with Selectable Brand Text and Images

Ensuring Compliance with Selectable Brand Text and Images

Mitigating Compliance Risks

One of the biggest concerns for Compliance officers is the possibility of field users creating content that may mislead consumers, exposing the organization to risks and potential fines. CampaignDrive addresses this concern by allowing brand teams to create appealing marketing content with pre-approved text and image options.

Related: 4 Ways a Brand Compliance System Increases Marketing ROI

Pre-Approval Streamlines the Process

Field users no longer need to generate unique content or search for new images independently. With CampaignDrive, brand teams can create captivating marketing materials and obtain pre-approval from the Compliance department. Once approved, the content becomes readily available for field users to incorporate into their campaigns.

Approval Loops for Unique Content

Approval Loops for Unique Content

Flexibility for Unique Content

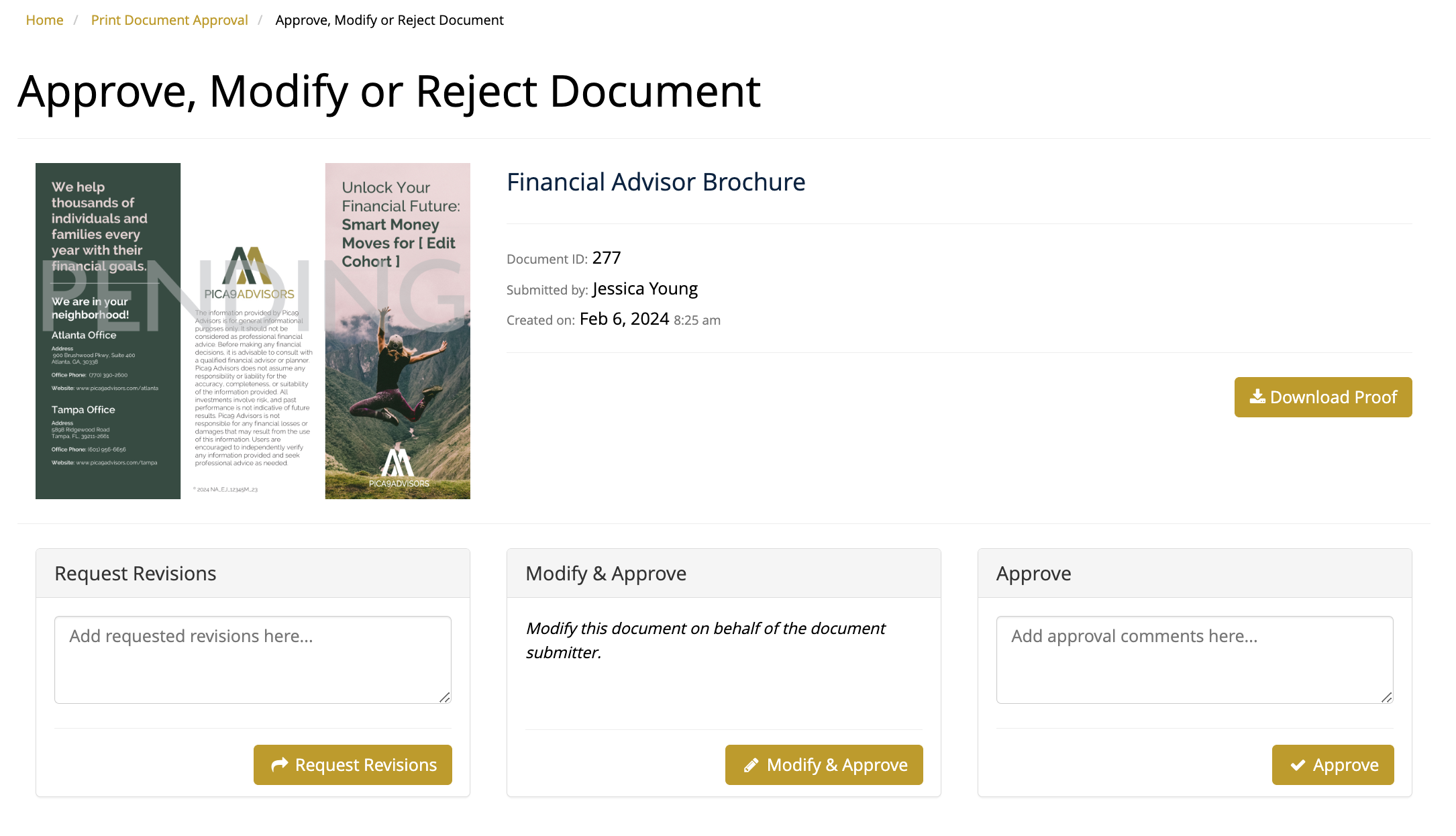

While not all content can be pre-created, CampaignDrive ensures that field users are not left stranded. The platform offers flexible template options tied to approval loops. When a document is marked as "completed," it undergoes a review by a Compliance officer.

Streamlining Edits and Approvals

If the document receives approval, the field user can promptly download a high-resolution version and proceed with their marketing initiatives. In cases where edits are necessary, the Compliance Officer can either make them on behalf of the user or send the document back for revisions, ensuring a streamlined and efficient approval process.

Related: Marketing Collateral Management for Financial Advisors

Navigating Compliance without Halting Marketing: The CampaignDrive Advantage

In the competitive landscape of banking, where time is of the essence, CampaignDrive emerges as a savior for Retail Bank and Credit Union marketers. By providing branded templates, pre-approved content options, and efficient approval loops, CampaignDrive ensures that compliance doesn't have to translate into a full stop for marketing material creation. Instead, it becomes a seamless part of the process, allowing marketing and sales teams to achieve their goals with speed and precision. To get started, click here for a free product demo.